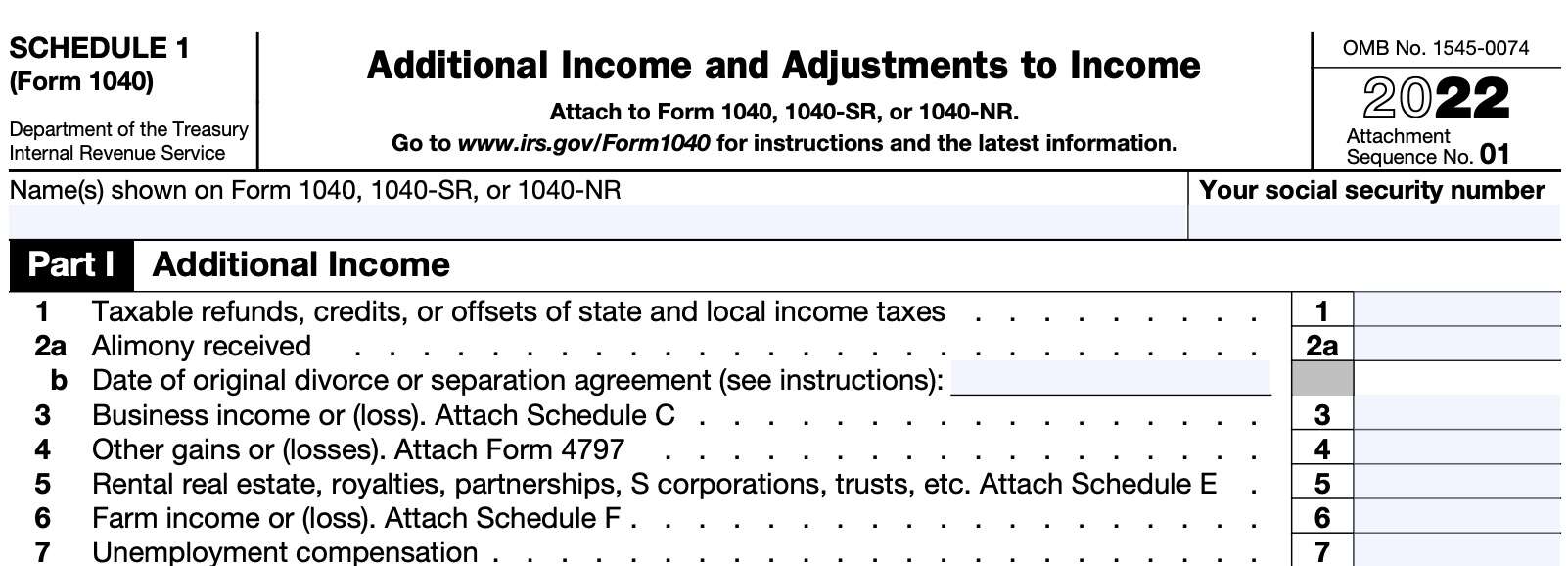

- Part I: Additional Income

- Part II: Adjustments to Income

How do I complete IRS Schedule 1?

There are two parts to this two-page tax form:

- Part I: Additional Income

- Part II: Adjustments to Income

Let’s start at the top of the IRS tax form. Before starting Part I, enter the taxpayer name or names as they appear on your federal income tax return, as well as your Social Security number.

Part I: Additional Income

In the first part of Schedule 1, we will enter additional items of income that we cannot directly enter into IRS Form 1040. The amount from Line 10 goes to Line 8 on Form 1040, 1040-SR, or 1040-NR.

Let’s start with Line 1.

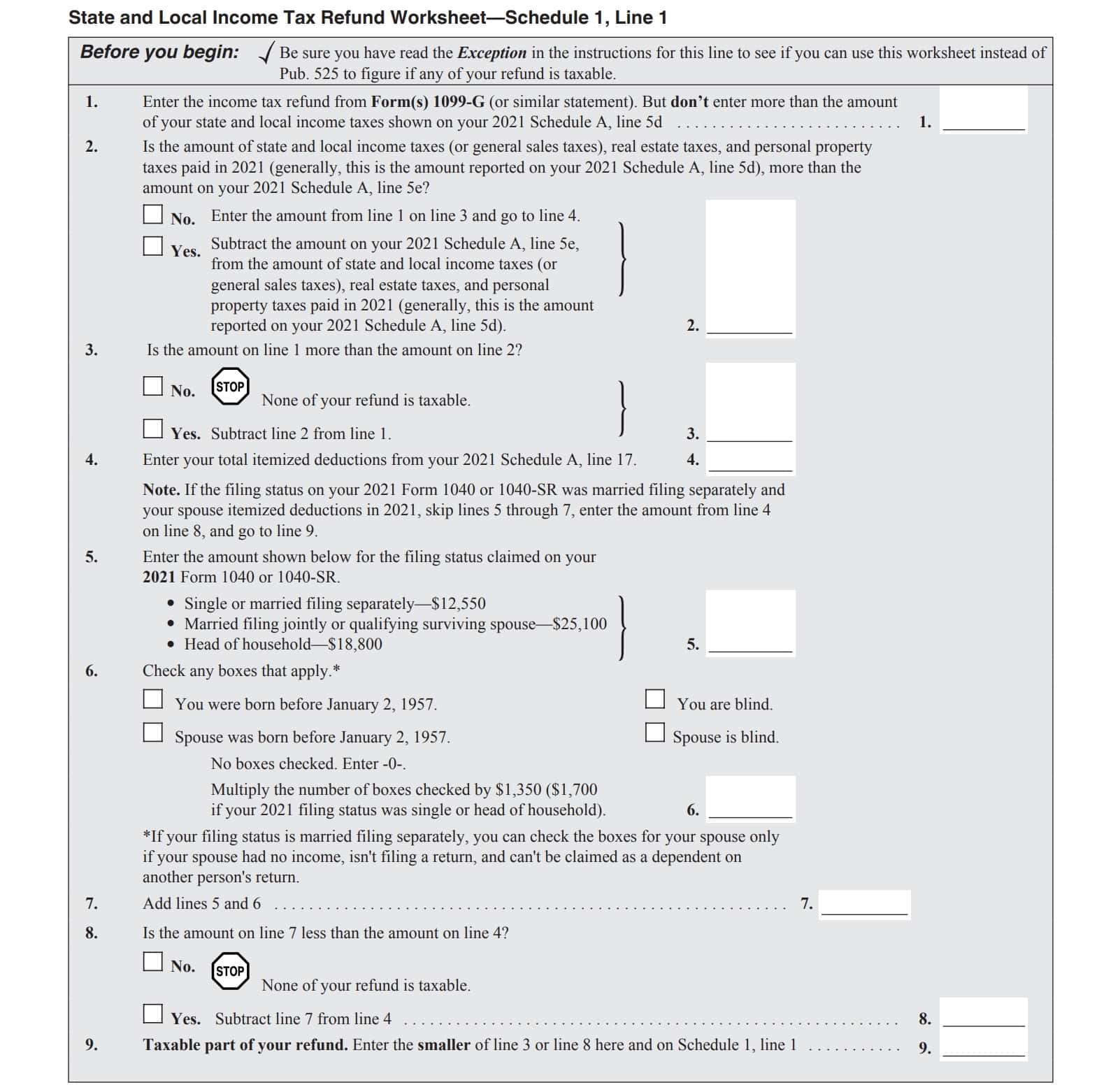

Line 1: Taxable refunds, credits, or offsets of state and local income taxes

Enter any taxable refunds, tax credits, or tax offsets from any state or local taxes.

None of your refund is taxable if, in the year you paid the tax, you either

- Took the standard deduction instead of itemizing deductions

- Elected to deduct state and local general sales taxes instead of income taxes

If you received a tax refund, tax credit, or offset of state or local taxes in the tax year, you may be required to report that amount in Line 1.

If you received a refund, credit, or offset in a different tax year from the one in which you paid the tax, you may need to complete the following worksheet to determine what to report in Line 1. This might happen if you received the tax benefit in a prior tax year, then had to pay the tax in the following year.

Line 2: Alimony

In Line 2a, enter amounts received as alimony or separate maintenance pursuant to a divorce or separation agreement that you entered on or before December 31, 2018, unless that agreement was changed after December 31, 2018, to expressly provide that alimony received isn’t included in your income.

Due to the Tax Cuts and Jobs Act, alimony received is not included in your income if you entered into a divorce or separation agreement after December 31, 2018.

In Line 2b, enter the month and year of your original divorce or separation agreement that relates to the alimony payment, if any, reported on Line 2a.

If you have alimony payments from more than one divorce or separation agreement, enter the month and year of the divorce or separation agreement for which you received the most income. Attach a statement listing the month and year of the other agreements.

Line 3: Business income or (loss)

If you operated a business or practiced your profession as a sole proprietor, report your income and expenses on Schedule C.

Enter the total business income or business loss in Line 3.

Line 4: Other gains or losses

If you sold or exchanged assets used in a trade or business, enter the amount of losses or gains on the disposition of assets in Line 4.

Line 5: Rental real estate, royalties, partnerships, S corporations, trusts, etc.

Complete IRS Schedule E if you received income from any of the following sources:

- Rental properties

- Royalties

- Partnerships

- S corporations

- Trusts

- Estates

Attach your completed Schedule E to your tax return.

Line 6: Farm income or loss

If you had farm income or losses during the tax year, you will need to complete IRS Schedule F. Enter the farm income or loss in Line 6.

Line 7: Unemployment compensation

If you received unemployment compensation during the calendar year, you should receive a copy of IRS Form 1099-G. Box 1 should contain the total unemployment compensation you received during the tax year. Report this number on Line 7.

If the Box 1 number is incorrect, only report the actual amount of unemployment compensation you received during the year.

If you contributed to a governmental unemployment compensation program or to a governmental paid family leave program, and you are not itemizing deductions on Schedule A, then reduce the Line 7 number by those contributions.

For taxpayers who itemize deductions, follow the instructions provided on IRS Form 1099-G.

If you repaid an overpayment of unemployment compensation that you received in the same tax year, subtract the repaid amount from the total unemployment payments you received. Enter the net result here.

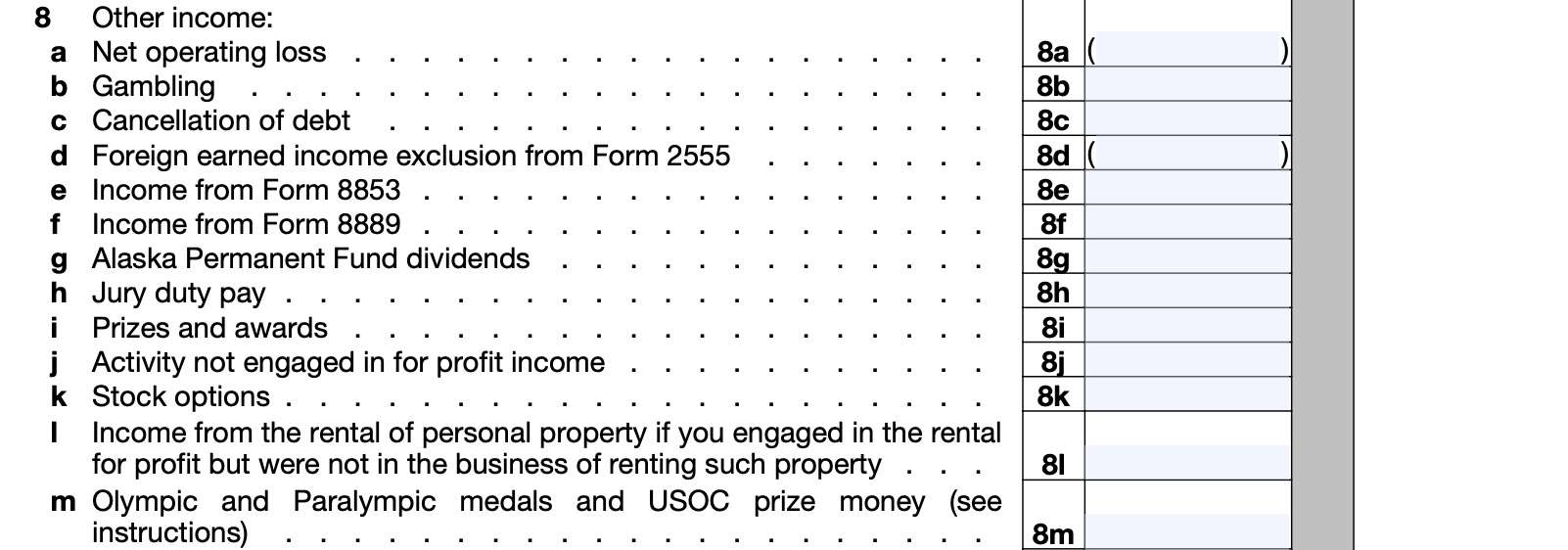

Line 8: Other income

The Line 8 instructions contains a variety of other income items.

Do not report any income from self-employment or fees that you received as a notary public. Instead, you must complete Schedule C, even if you don’t have any business expenses.

Also don’t report any nonemployee compensation shown on Form 1099-MISC, 1099-NEC, or 1099-K. You will need to refer to the Instructions for Recipient included on the respective tax form to determine how to report that income.

Let’s take a closer look at some of these income items.

Line 8a: Net operating loss

Enter on Line 8a any net operating loss (NOL) deduction from an earlier year as a negative number in the pre-printed parentheses. This amount will be subtracted from the rest of the income items from Line 8b to Line 8z.

Line 8b: Gambling income

Enter any gambling winnings. Gambling winnings include the following items:

- Lotteries

- Raffles

- Lump-sum payment from the sale of a right to receive future lottery payments

Attach a copy of IRS Form 1099-G if income tax payments were withheld from your gambling winnings.

Line 8c: Cancelation of debt

In Line 8c, enter any cancelled debt for which you received a copy of IRS Form 1099-C. Not all cancelled debt is considered taxable income.

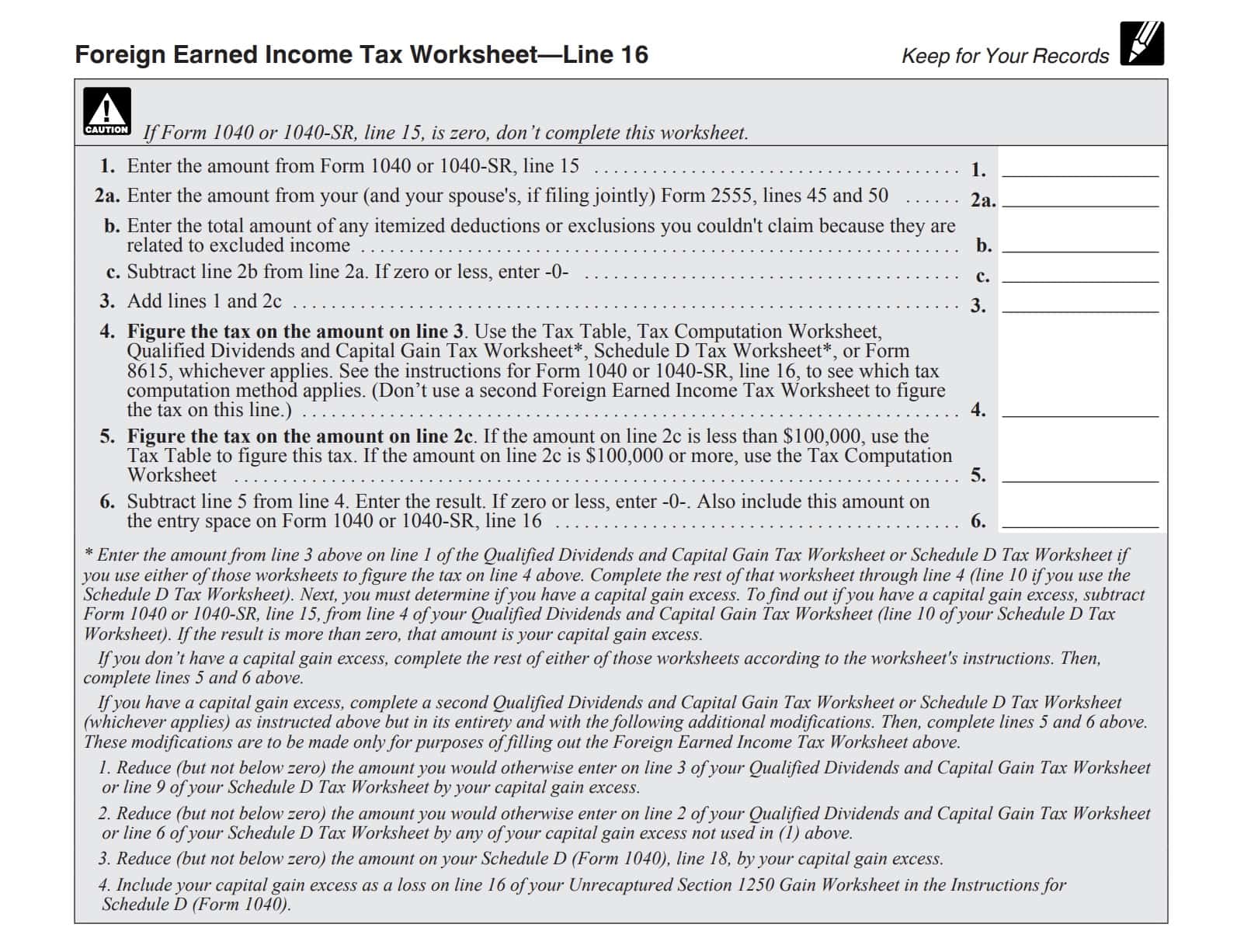

Line 8d: Foreign earned income exclusion

Enter the amount of your foreign earned income and housing exclusion from IRS Form 2555, Line 45, in parentheses as a negative number. This amount will be subtracted from the other items of income in Lines 8a through 8z.

Also, complete the foreign earned income tax worksheet, located below.

Line 8e: Income from IRS Form 8853

Complete IRS Form 8853 if you had taxable distributions from an Archer MSA. After you complete Form 8853, enter the following lines of income from the completed form:

Line 8f: Income from IRS Form 8889

Report taxable distributions from a health savings account on IRS Form 8889. After doing so, enter the total of the following lines from your completed Form 8889:

- Line 16: Taxable HSA distributions

- Line 20: Total income

Line 8g: Alaska Permanent Fund Dividends

If you received dividends from the Alaska Permanent Fund, enter the total amount of dividends received here.

Line 8h: Jury duty pay

If you received compensation for jury duty, enter that amount in Line 8h. If you gave back some or all of your jury duty compensation because your employer paid you during your jury duty time, you might be able to deduct this amount on Line 24a, discussed below.

Line 8i: Prizes and awards

Enter any prize or award money you received during the year.

However, if you received prizes or awards as an Olympic or Paralympic athlete, or if you received USOC prize money, report that amount in Line 8m, instead.

Line 8j: Activity not engaged in for profit income

If you participated in an activity, but not for profit, enter any income you received as a result of that activity.

For example, if you are a race horse owner, but do not have a for profit business, you might enter any income from horse races during the year.

IRS Publication 535, Business Expenses, contains additional information about the difference between an activity for profit and an activity not for profit.

Line 8k: Stock options

In Line 8k, report any income from the exercise of stock options that you did not otherwise report on IRS Form 1040.

Line 8l: Income from the rental of personal property

If you earned income from the rental of personal property, but were not in the business of renting such property, enter the rental income in Line 8l.

If you incurred expenses in conjunction with this income, you may be able to deduct those expenses in Line 24b, later.

Line 8m: Olympic & Paralympic medals and USOC prize money

Enter any Olympic or Paralympic medals, as well as prize money you earned from the United States Olympic Committee (USOC) on Line 8m.

These amounts should be reported to you in Box 3 of Form 1099-MISC.

If your adjusted gross income is not more than $1,000,000 ($500,000 if married filing separately), this is considered nontaxable income. You should include the Box 3 amount in Line 8m, then subtract it on Line 24c, as an adjustment to income, later.

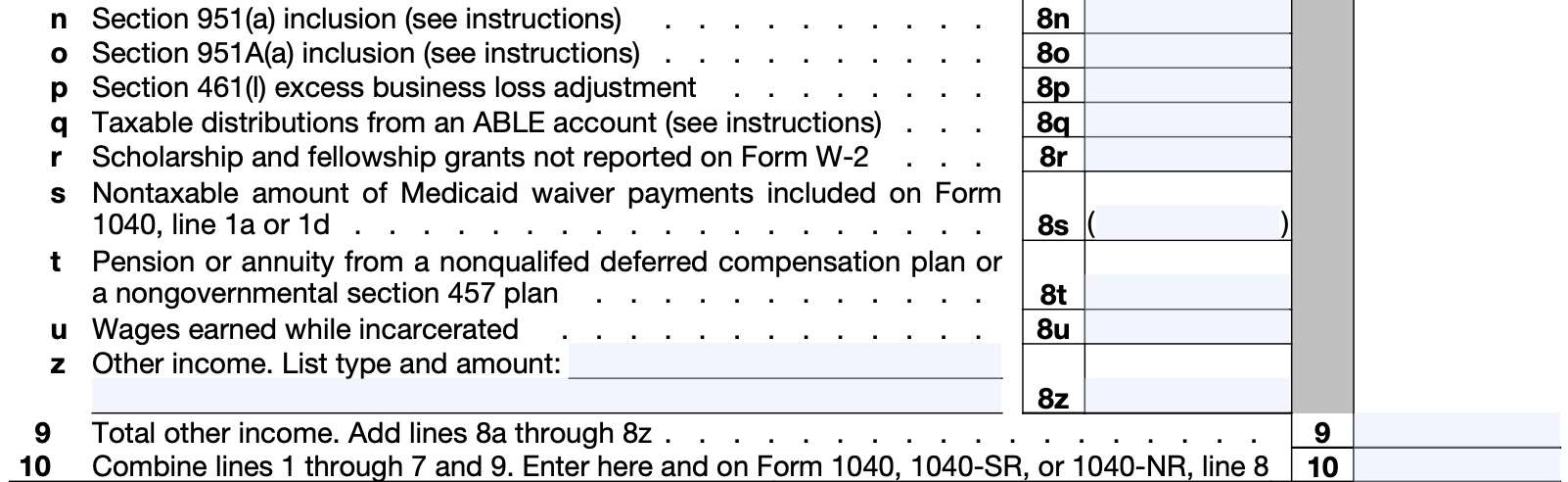

Line 8n: Section 951(a) inclusion

On Line 8n, enter any amount from the following lines on IRS Form 5471, Schedule I:

- Lines 1a through 1h

- Line 2

Internal Revenue Code Section 951 generally requires that a U.S. shareholder of a controlled foreign corporation include in income its pro rata share of the corporation’s subpart F income and its amount determined under IRC Section 956.

Line 8o: Section 951A(a) inclusion

On Line 8o, enter the sum of any amounts reported on Part II, Line 5 of IRS Form 8992.

IRC Section 951A generally requires that a U.S. shareholder of a controlled foreign corporation include in income its global intangible low-taxed income (GILTI).

Attach your completed Form 8992 to your income tax return.

Line 8p: Section 461(l) excess business loss adjustment

In Line 8p, enter the amount of your excess business loss from IRS Form 461, Line 16.

Line 8q: Taxable distributions from an ABLE account

You may have to report and pay additional taxes on IRS Form 5329 if you received a taxable distribution from an ABLE account.

Distributions from this type of account may be taxable if they:

- Exceed the designated beneficiary’s qualified disability expenses, and

- Were not included in a qualified rollover

Line 8r: Scholarship and fellowship grants not reported on Form W-2

In Line 8r, enter the amount of scholarship and fellowship grants that were not reported on Form W-2. If you were a degree candidate, only include the amounts for expenses not including tuition and course-related expenses.

For example, you would report grants that you received to offset room, board, and travel expenses on Line 8r.

Line 8s: Nontaxable amount of Medicaid waiver payments

In Line 8s, enter the nontaxable amount of Medicaid waiver payments included on Line 1a or Line 1d of your Form 1040.

Certain Medicaid waiver payments you received for caring for someone living in your home with you may be nontaxable.

If nontaxable payments were reported to you in box 1 of Form(s) W-2, report the amount on

Line 1a of your Form 1040.

Report the amount on Line 1d of your Form 1040 if you

- Did not receive a Form W-2 for nontaxable payments, or you received nontaxable payments that you didn’t report on Line 1a, and

- Choose to include nontaxable amounts in earned income for purposes of claiming a credit or other tax benefit

Then, on Line 8s, enter the total amount of the nontaxable payments that you reported on Line 1a or Line 1d. This goes into Line 8s as a negative number, in parentheses.

Line 8t: Pension or annuity from a Section 457 plan

Enter the amount that you received as a pension or annuity from a nonqualified deferred compensation plan or a nongovernmental 457 plan.

You should see this in Box 11 of Form W-2. If you received such an amount, but Box 11 is blank, contact your employer or payer to determine the amount you received.

Line 8u: Wages earned while incarcerated

In Line 8u, enter the amount that you received for services performed while serving as an inmate in a penal institution.

Line 8z: Other income

Use this line to report any taxable income not reported elsewhere on your return or other schedules.

Examples of other income can include:

- Reimbursements or other amounts received for eligible expenses that were deducted in an earlier tax year

- Reemployment trade adjustment assistance (RTAA) payments.

- These payments should be shown in Box 5 of IRS Form 1099-G

- See Retirement Plan Contributions in IRS Publication 525, Taxable and Nontaxable Income

- See Fractional Interest in Tangible Personal Property in IRS Publication 526, Charitable Contributions

- Interest and an additional 10% tax apply to the amount of the recapture. See the instructions for IRS Schedule 2, Line 17g.

- IRS Publication 525, Taxable and Nontaxable Income contains additional details.

- If any of your disaster relief payment is taxable, attach a statement showing the total payment received and how you figured the taxable part.

Nontaxable income

When calculating taxable income items to include in Line 8z, do not include the following nontaxable items:

- Child support payments

- Payments you received to help you pay your mortgage loan under the HFA Hardest Hit Fund or the Homeowner Assistance Fund

- Any Pay-for-Performance Success Payments that reduce the principal balance of your home mortgage under the Home Affordable Modification Program

- Life insurance proceeds received because of someone’s death

- Exceptions exist for certain employer-owned life insurance contracts

Line 9: Total other income

Combine Lines 8a through 8z. Enter the result in Line 9.

Line 10

Combine Lines 1 through 7, and Line 9. Enter the total in Line 10, and on Line 8 of your federal tax return.

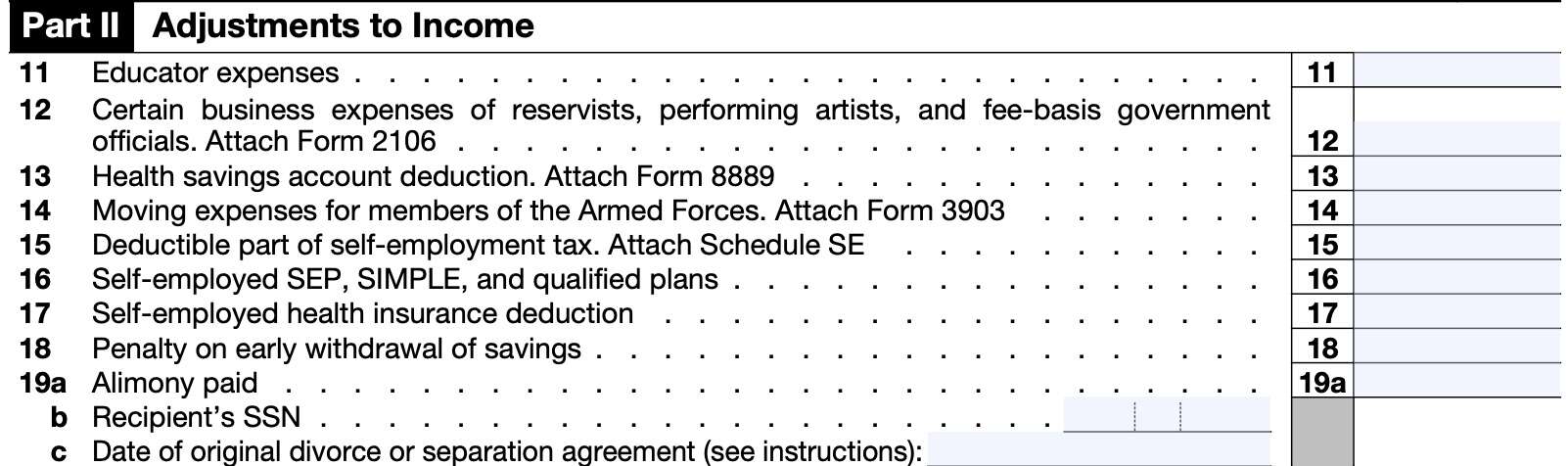

Part II: Adjustments to Income

In Part II, we’ll calculate adjustments to income. These adjustments to income lower adjustable gross income, also known as AGI.

Line 11: Educator expenses

Enter qualified educator expenses in Line 11.

If you were an eligible educator during the tax year, you can deduct up to $300 of qualified expenses you paid during the taxable year.

If you and your spouse are filing jointly and both of you were eligible educators, the maximum deduction is $600. However, neither spouse can deduct more than $300 of their qualified expenses on Line 11.

Eligible educator

You are an eligible educator if you meet the following criteria:

- You were a teacher, instructor, counselor, principal, or aide

- You worked in a K-12 school

- You worked at least 900 hours during a school year

Qualified educator expenses

Qualified educator expenses include ordinary and necessary expenses paid:

- For professional development courses related to the curriculum you teach or to the students you teach; or

- In connection with books, supplies, equipment, and other materials used in the classroom.

- Including computer equipment, software, and services

However, qualified expenses don’t include expenses for home schooling or for nonathletic supplies for courses in health or physical education.

You must reduce your qualified educator expenses by the following:

- Excludable U.S. series EE and I savings bond interest from IRS Form 8815.

- Nontaxable qualified tuition program earnings or distributions

- Any nontaxable distribution of Coverdell education savings account earnings

- Any reimbursements you received for these expenses that were not reported on your Form W-2

Line 12: Certain business expenses

If you are any of the following, you may deduct certain business expenses from gross income:

- Reservist in the Armed Forces who traveled more than 100 miles from home to perform services as a National Guard or reserve component member

- Performing artist

- Fee-basis government official

If you are any of the above, you may deduct certain unreimbursed business expenses on IRS Form 2106.

Line 13: Health savings account deduction

You may be able to take deduct any health savings account contributions from gross income to reduce your tax liability. Attach a copy of your completed Form 8889 to document your HSA deduction.

Line 14: Moving expenses for members of the Armed Forces

You can deduct moving expenses if:

- You are a member of the Armed Forces on active duty and

- You perform a permanent change of station (PCS) move due to a military order

If you’re claiming the moving expense deduction on IRS Form 3903, attach your completed form to your tax return.

Line 15: Deductible part of self-employment tax

If you had self-employment income, and owe self-employment tax, complete IRS Schedule SE

to figure the amount of your deduction.The deductible part of your self-employment tax is on Line 13 of Schedule SE.

Line 16: Self-employed SEP, SIMPLE, and qualified plans

If you were self-employed or a partner, you may be able to take this tax deduction.

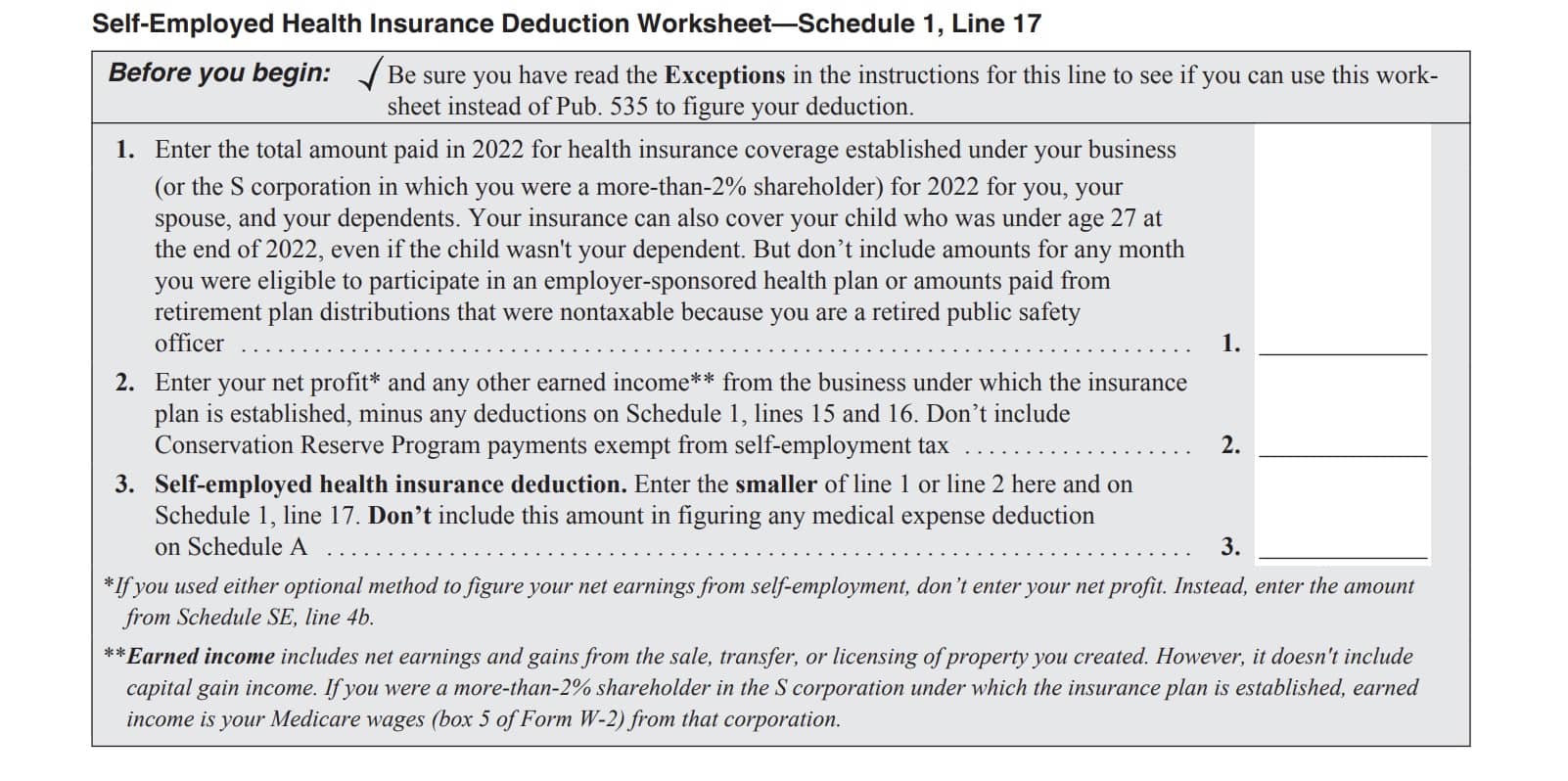

For more details, see IRS Publication 560 Retirement Plans for Small Business (SEP, SIMPLE and Qualified Plans)Line 17: Self-employed health insurance deduction

You may be able to deduct the amount you paid for health insurance for yourself, your spouse, and your dependents, if one of the following conditions applies:

- You were self-employed and had a net profit for the year reported on Schedule C or F

- You were a partner with net earnings from self-employment

- You used one of the optional methods to figure your net earnings from self-employment on Schedule SE

- You received wages in 2022 from an S corporation in which you were a more-than-2% shareholder

If you qualify to take the deduction, use the Self-Employed Health Insurance Deduction Worksheet to figure the amount you can deduct.

Line 18: Penalty on early withdrawal of savings

Enter the penalty amount reflected on your IRS Form 1099-INT or IRS Form 1099-OID.

Line 19: Alimony paid

If you made payments to or for your spouse or former spouse under a divorce or separation agreement entered into on or before December 31, 2018, you may be able to take this deduction.

If you are able to deduct alimony paid, enter the amount of alimony paid in Line 19a.

In Line 19b, enter your spouse’s or former spouse’s Social Security number.

For Line 19c, enter the month and year of the date of the divorce or separation agreement.

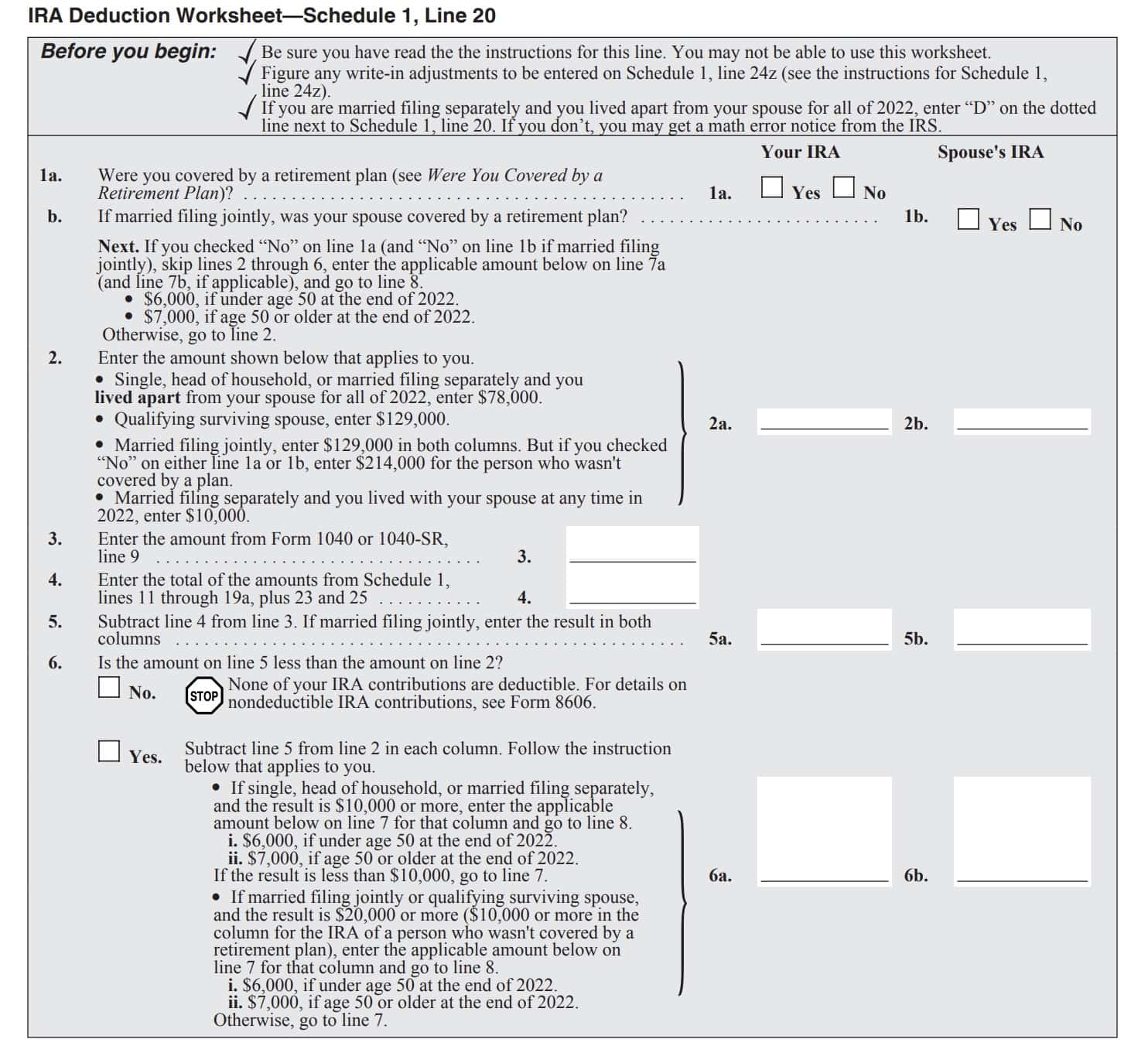

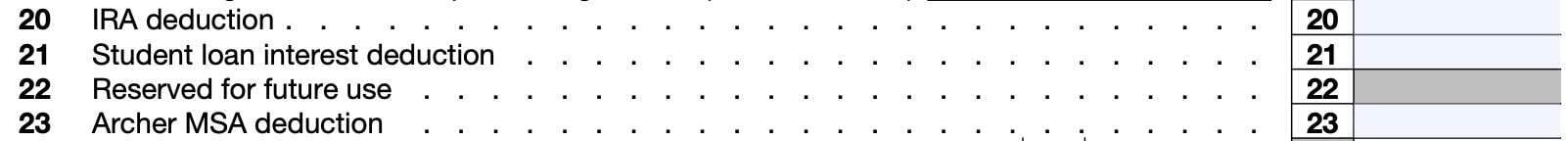

Line 20: IRA deduction

If you made contributions to a traditional IRA for the tax year, you may be able to take an IRA deduction. However, you must have earned income to contribute to an IRA.

For IRA purposes, earned income includes the following:

- Alimony and separate maintenance payments

- For members of the U.S. Armed Forces, earned income includes any nontaxable combat pay you received while serving in a combat zone

- For self-employed individuals, earned income is generally your net earnings from

self-employment if your personal services were a material income-producing

factor

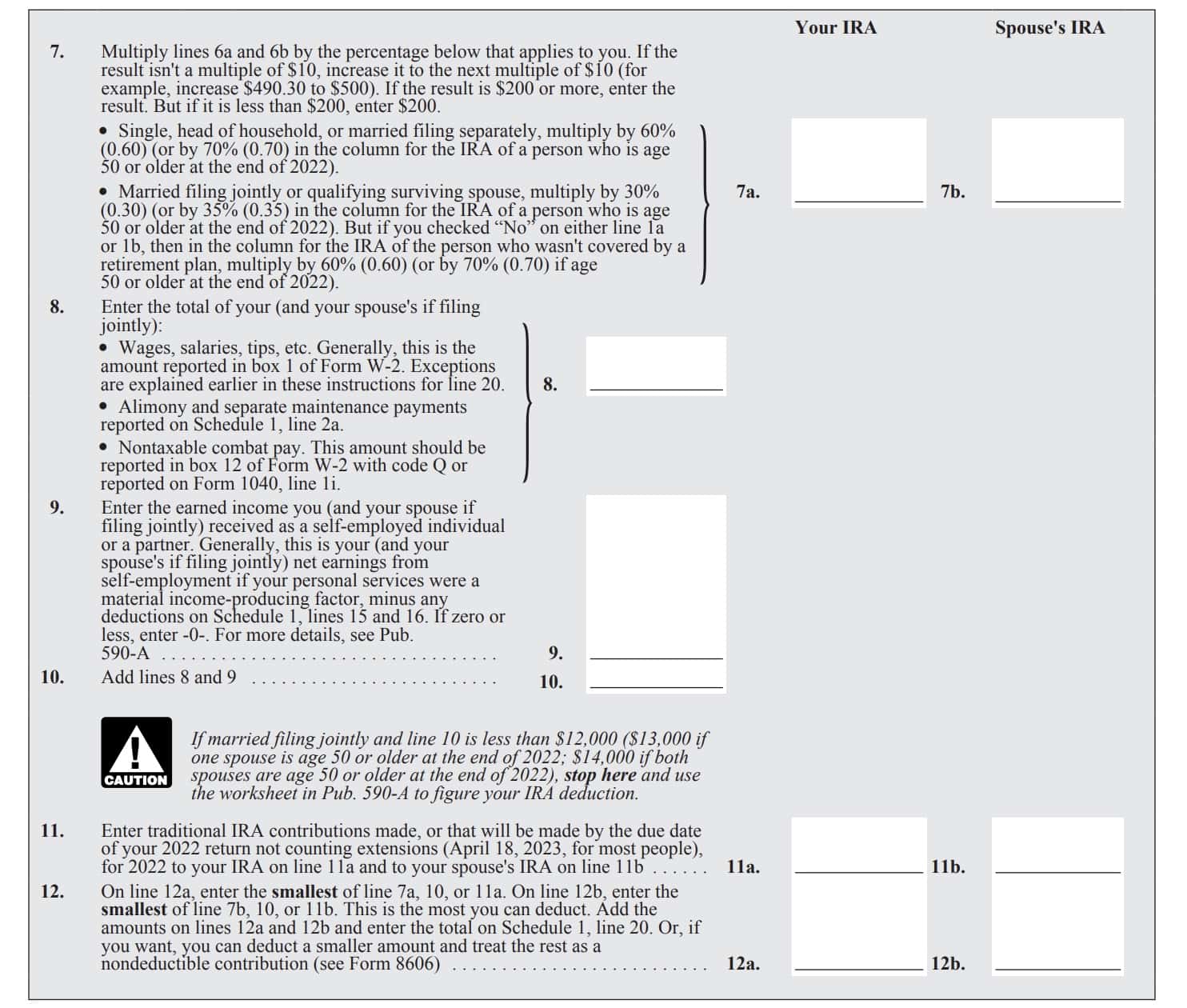

The IRS instructions provide an IRA deduction worksheet to help taxpayers calculate their deduction, below.

IRA Deduction worksheet

Before using the worksheet, you should be aware of the following:

- You can’t deduct contributions to a Roth IRA

- If you are filing a joint return and you or your spouse made contributions to both a traditional IRA and a Roth IRA, use the instructions in IRS Publication 590-A, instead of the worksheet

- You cannot deduct elective contributions to a qualified retirement plan or the federal Thrift Savings Plan

- If you made contributions in the tax year that you already deducted for a previous tax year, you cannot deduct the contributions again

- If you received income from a nonqualified deferred compensation plan or nongovernmental Section 457 plan that is included in Box 1 of your Form W-2, or in Box 1 of Form 1099-NEC, don’t include that income on Line 8 of the worksheet

- You must file a joint return to deduct contributions to your spouse’s IRA

- You cannot include rollovers as part of your deduction

- Don’t include any repayments of qualified reservist distributions

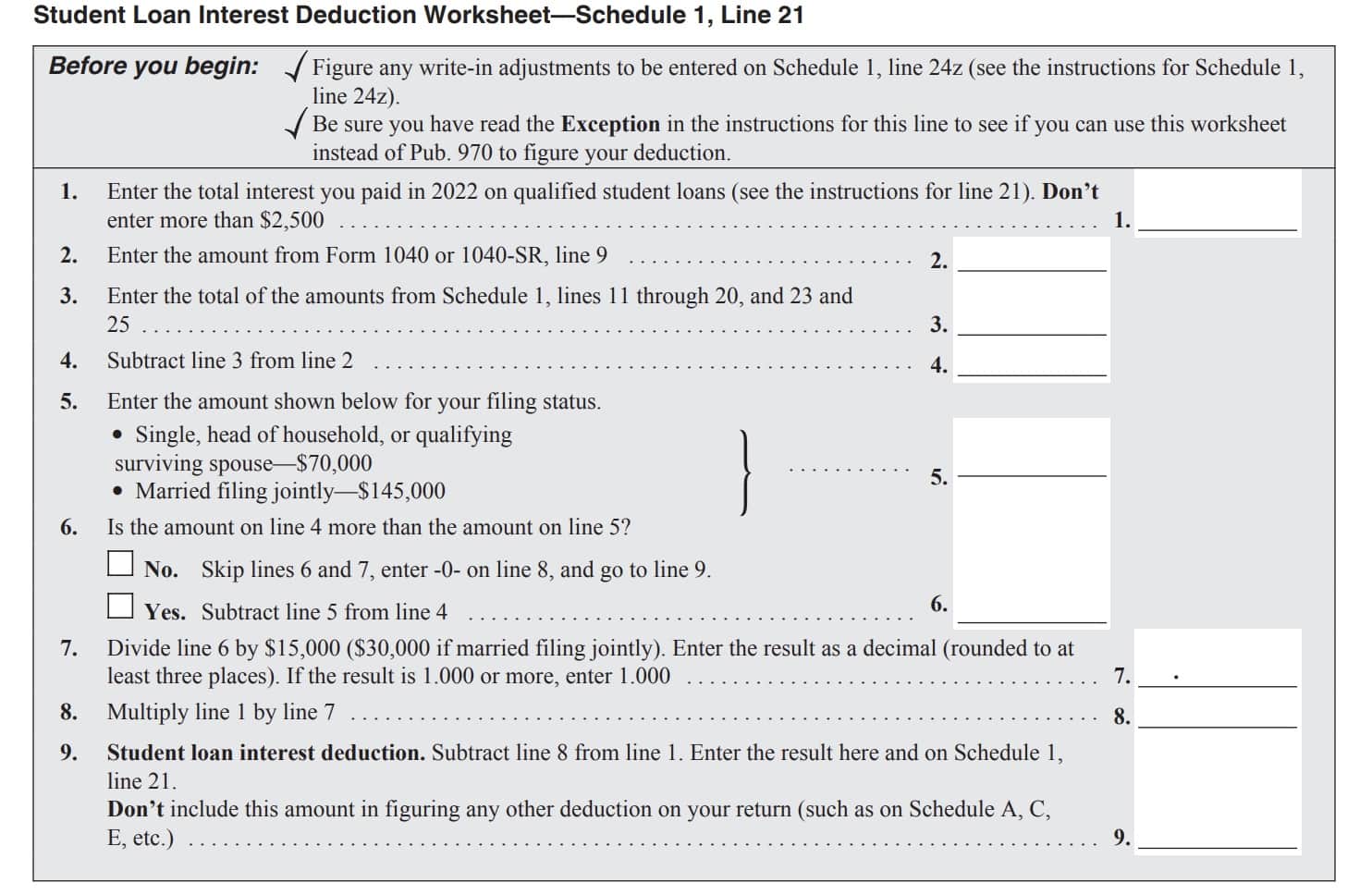

Line 21: Student loan interest deduction

You can take the student loan interest deduction only if all of the following apply:

- You paid interest on a qualified student loan

- Your filing status is any status except married filing separately

- Your modified adjusted gross income (AGI) is less than the following:

- Single, head of household or qualifying surviving spouse: $85,000

- Married filing jointly: $175,000

- Use lines 2 through 4 of the worksheet in these instructions to figure your modified AGI.

Qualified student loans

A qualified student loan is any loan you took out to pay the qualified higher education expenses for any of the following individuals who were eligible students:

- Yourself or your spouse

- Any person who was your dependent when the loan was taken out

- Any person you could have claimed as a dependent for the year the loan was taken out except that:

- The person filed a joint return

- The person had gross income that was equal to or more than the exemption amount for that year

- You, or your spouse if filing jointly, could be claimed as a dependent on someone else’s income tax return

If you meet all of the above criteria, then use this student loan interest deduction worksheet to calculate your tax deduction.

Line 22: Reserved for future use

Line 23: Archer MSA deduction

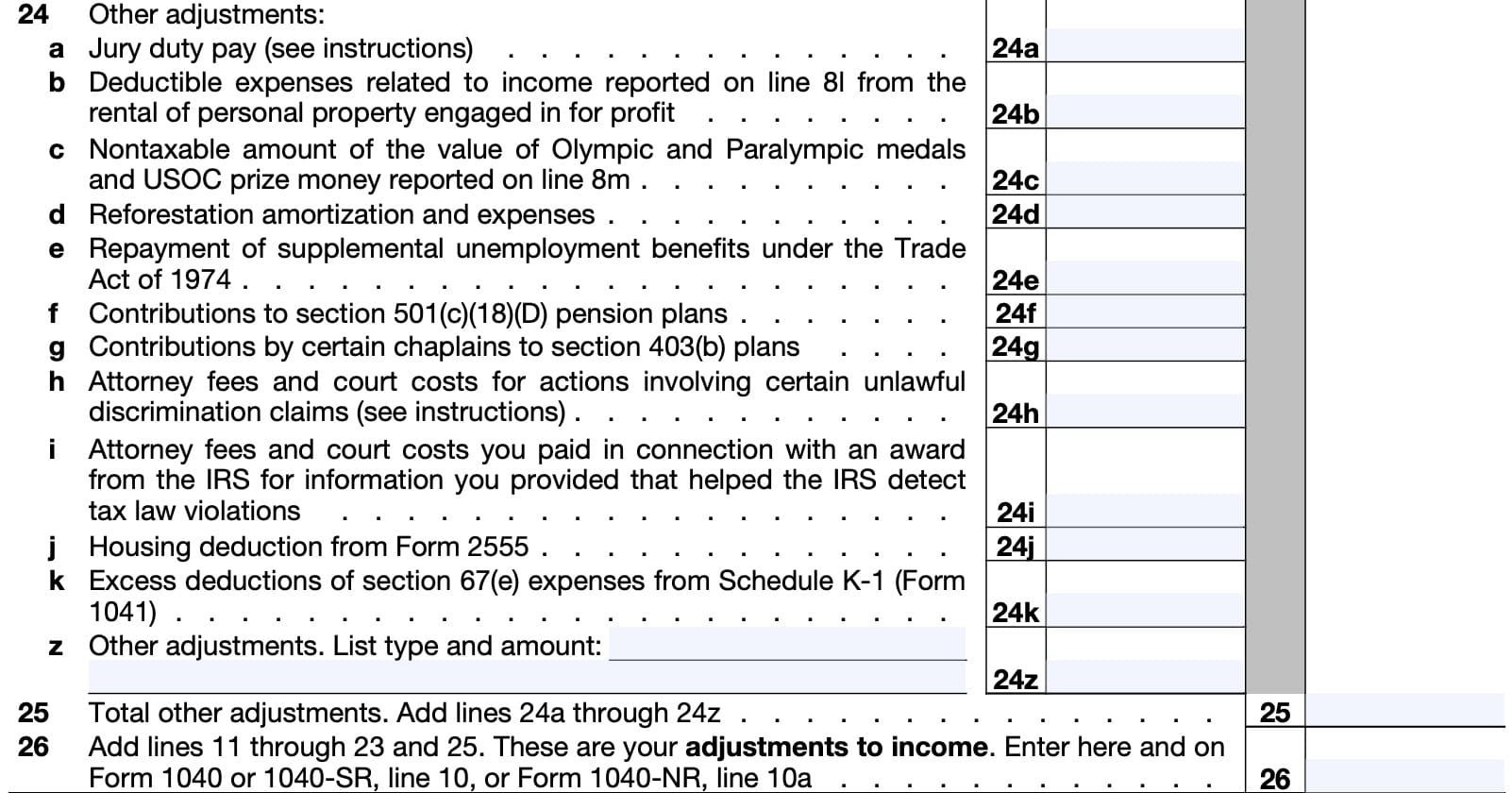

Line 24

This line contains other adjustments to income. Let’s start with jury duty pay on Line 24a.

Line 24a: Jury duty pay

In Line 24a, enter your jury duty pay if you gave the pay to your employer because your employer paid your salary while you served on jury duty.

Line 24b: Deductible expenses related to income reported on Line 8l

Enter the deductible expenses related to income reported on Line 8l from the rental of personal property

Line 24c: Nontaxable amount of Olympic and Paralympic medals and USOC prize money on Line 8m

Enter the nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money that you reported on Line 8m.

Line 24d: Reforestation amortization and expenses

Enter reforestation amortization and expenses. IRS Publication 535, Business Expenses, contains more information.

Line 24e: Repayment of supplemental unemployment benefits

Enter any repayment of supplemental unemployment benefits under the Trade Act of 1974. IRS Publication 525, Taxable and Nontaxable Income, contains additional details about this above the line tax deduction.

Line 24f: Contributions to Section 501(c)(18)(D) plans

Enter any contributions to Section 501(c)(18)(D) plans. Refer to IRS Publication 525 for more information.

Line 24g: Contributions by certain chaplains to Section 403(b) plans

Line 24h: Attorney fees and court costs involving certain unlawful discrimination claims

In Line 24h, you may enter any attorney fees and court costs for actions involving certain unlawful discrimination claims. You may only enter attorney fees and court costs to the extent of gross income from such actions.

In other words, you cannot claim more in expenses than you realized in total income.

Line 24i: Attorney fees and court costs paid in connection to an IRS award

If the Internal Revenue Service paid you an award for information you provided that helped detect tax law violations, you may enter enter attorney fees and court costs you paid in connection to this information, up to the amount of the award includible in your gross income.

Line 24j: Housing deduction from IRS Form 2555

Enter the housing deduction that you might have claimed as an exception to foreign earned income on IRS Form 2555.

Line 24k: Excess deductions of Section 67(e) expenses

Enter excess deductions of IRC Section 67(e) expenses from Schedule K-1 (Form 1041), Box 11, Code A.

Line 24z: Other adjustments

Enter the total of other adjustments to income not previously stated.

Line 25: Total other adjustments

Add Lines 24a through 24z. Enter the result here.

Line 26

Combine Lines 11 through 23, and Line 25. These are adjustments to income.

Enter the total in Line 26, and on Line 10 of your federal tax return.

Video walkthrough

Frequently asked questions

What is IRS Schedule 1?Schedule 1 is the tax form that the IRS provides for individual taxpayers to report additional income items or adjustments to income that they cannot report on their income tax return.

Do I need to complete IRS Schedule 1?Only taxpayers who have items of income or adjustment to gross income need to report these items on IRS Schedule 1.

Where can I find IRS Schedule 1?

Like with other tax forms, you can find IRS Schedule 1 on the IRS website. For your convenience, we’ve included the most recent version of this tax form below.